Share

The Business of Fashion Podcast

A weekly podcast presenting thoughtful editorial stories and fashion-oriented perspectives in a fresh way.

The Business of Fashion has gained a global following as an essential daily resource for fashion creatives, executives and entrepreneurs in over 200 countries. It is frequently described as “indispensable,” “required rea

Latest episode

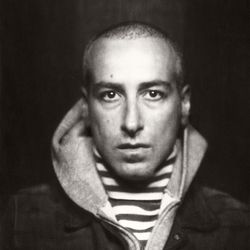

Thom Bettridge Says Viral Magazine Covers Are Only Sugar Highs

46:24|i-D magazine was founded in 1980 by Terry and Tricia Jones, pioneering a new kind of fashion storytelling that mixed street style with high fashion, always with an eye — and a wink — to the future. The magazine has had its ups and downs, and in 2023 fell victim to the bankruptcy of Vice, which had acquired i-D from its founders in 2012. Enter Karlie Kloss and her burgeoning media company, Bedford Media, which has plans to revitalise i-D under a new editor-in-chief, Thom Bettridge with experience at 032c, Interview, Highsnobiety, and Ssense. Now, Bettridge is on a mission to re-establish i-D as a cultural institution for a new generation — one that values community over clicks and retention over viral attention.“I've worked on viral covers and while they can do so much for your exposure as a small brand, at the end of the day, it's really like a sugar high. That famous person's fans are there to see the person they like. Not that many of them actually stick around,” says Bettridge. “We're moving from this attention era to a retention era, where the smarter brands are figuring out how to build a narrative people are invested in.”Bettridge joins BoF founder and CEO Imran Amed to talk about his journey to i-D and what it takes to relaunch an iconic title for a new era.Key Insights: Moving from biannual publications like 032C to the fast-paced, blog-style environment of Highsnobiety, Bettridge learned to step back from editing every piece, focusing instead on nurturing a team that could maintain quality content at a rapid digital pace. "I had to cultivate a team that is going to do great work even when I'm not directly touching it," he says. "It was a big growth thing, learning how to be more of a coach than an editor of editors."At e-commerce platform Ssense, Bettridge discovered content was most successful when it offered intrinsic value, fostering long-term brand loyalty. He likens Ssense's editorial content to a great coffee shop attached to a hotel: Even if people aren’t shopping for luxury fashion every day, they could drop by for a daily dose of engaging content, building a habitual connection to the brand. "What really worked was if you just made great content, you then became part of someone's digital diet in a way that built loyalty with the brand," he explains.For the relaunch cover of i-D, Bettridge chose Enza Khoury, a trans woman living in the Republican state of Ohio in the US, after a casting call brought in over 800 video submissions. “We really wanted to find someone who encapsulates the present moment, and feels like a representative of our time,” Bettridge explains. In addition to her charisma, Enza’s personal story captured something bigger. “It almost felt like her life was telling a story of what it means to live today.”Bettridge emphasises shifting from viral celebrity-driven covers to nurturing a dedicated audience. He describes viral covers as a "sugar high," suggesting the real value lies in sustained engagement. "You can create this huge wave of eyeballs, but are these people actually going to buy what you're selling?" he asks. The goal, he says, is to transition "from an attention era to a retention era." Additional Resources:i-D Magazine Appoints Thom Bettridge Editor in Chief Op-Ed | Go Big or Go Hyper-Niche

More episodes

View all episodes

Is Forever 21 Shein's Biggest Victim Yet?

21:36|Once a dominant player in fast fashion, Forever 21 recently filed for bankruptcy for the second time in six years, marking the likely end of its run as a physical retailer. The chain, known for introducing ultra-affordable, trend-driven clothing to American malls, struggled to remain relevant as competitors like Zara, H&M, and later Shein and Temu offered faster, cheaper, and more digitally-savvy alternatives. After its initial bankruptcy in 2019, Forever 21 was acquired by Authentic Brands Group and mall operator Simon Property Group, but despite various turnaround attempts – including unusual collaborations and international relaunches – it failed to recapture its former success.Retail editor Cathaleen Chen joins The Debrief to unpack what Forever 21’s fall says about the future of fast fashion.Key Insights: Chen argues that Forever 21’s downfall is largely due to its loss of cultural cachet. “You don't see influencers peddling Forever 21 in the way that you see influencers still promoting Shein, and I think that's a huge factor. You have to spend that money to be relevant,” says Chen.Chen contends that fast fashion retailers like Forever 21 have always struggled with establishing a unique identity, which ultimately made it difficult for them to maintain customer loyalty. “The problem with Wet Seal, Rue 21, and now Forever 21 is that these retailers never really had any kind of identity,” she explains.The retailer’s failure to evolve beyond chasing transient trends has left it vulnerable to more agile competitors. “It's not about just chasing fashion, fashion, fashion the way that I think Forever 21 never got out of, the way that Shein dominates. It's about going the other direction and creating products that your customers want at a level of quality,” says Chen.Looking forward, success in fast fashion will require more than affordability. Chen believes future winners must combine low prices with a compelling retail experience: “There is an element of surprise and delight in that shopping experience. It can't just be cheap, affordable – it needs to offer something more.”Additional Resources:The Year Ahead: Deconstructing Fast Fashion’s Future | BoF Why Shein Keeps Buying Its Rivals | BoF

Breaking News: Demna Takes Gucci, Versace Enters a New Creative Chapter

26:38|Demna's move to Gucci, announced after weeks of feverish speculation, stunned industry observers and sent shockwaves through financial markets, with Kering shares dropping sharply by more than 12%. While some hail this as an opportunity for Demna to reinvent Gucci through his distinctive cultural lens, others question his ability to break free from his Balenciaga legacy.. BoF founder and editor-in-chief Imran Amed posits, “The really big question here is, can Demna do something different?”Meanwhile, Donatella Versace’s transition from Chief Creative Officer to Chief Brand Ambassador marks the end of a storied era and the beginning of a new chapter under Dario Vitale. Highlighting Donatella’s cultural impact, BoF editor-at-large Tim Blanks notes, “Versace was one of the few names that registered with people who didn't know anything about fashion.” Fresh off a stellar tenure at Miu Miu, where he helped to ignite record growth, Vitale faces the ambitious task of balancing Versace's iconic legacy with a renewed contemporary relevance. With whispers of potential acquisition by Prada Group swirling, Versace stands at the precipice of transformation.Additional Resources:Why Gucci Picked Demna | BoF Dario Vitale to Succeed Donatella Versace as Chief Creative Officer of Versace | BoF

Tim Blanks and Imran Amed Reflect on Autumn/Winter 2025

52:49|This season, all eyes were on the debuts of Haider Ackermann at Tom Ford and Sarah Burton at Givenchy. Meanwhile, designs at Alaïa and Valentino continued to push boundaries with daring silhouettes that either stood away from the body or felt purposely incomplete. Behind the new faces and unconventional shapes was a deeper exploration of eroticism. From Ackermann’s sensual glamour at Tom Ford to what Tim Blanks calls the “quiet eroticism” of Burton’s Givenchy, designers seemed united by a playful fascination with the body — and a desire to subtly challenge its boundaries.“Fashion is a very fetishistic art form,” says Tim Blanks, BoF’s editor-at-large. “It has its fixations on the body and the way it fetishizes objects, but fashion is about fetishizing beauty and ugliness. A lot of these different things have been coming up over the last few years.”Following the conclusion of the Autumn/Winter 2025 shows, Blanks sits down with BoF founder and editor-in-chief Imran Amed to discuss the highlights of fashion month.Key Insights: Across the season, there was plenty of body on display. At Alaïa, Pieter Mulier presented striking new silhouettes that played with unusual proportions, creating shapes that stood away from the body. These exaggerated forms, described vividly by Amed as "body condoms," challenged the relationship between clothes and the body. At Duran Lantink, prosthetic pieces humorously toyed with ideas of eroticism. “What are they trying to say with these clothes?” asks Blanks. “There is a new body consciousness and people want to show off their svelte new forms.”Ackermann’s debut successfully merged Tom Ford’s famed sexual glamour with a reflective, intimate approach. “Tom is a sexualist and Haider is a sensualist, but there was a compatibility there in the erotic rigour in both of their work,” says Blanks. “I thought Haider did a wonderful job of doing a Haider Ackermann for Tom Ford collection; honouring the essence of one, but really bringing the dynamism of the new.”Also facing a house with a storied heritage, Burton’s debut collection for Givenchy returned to its earliest codes and patterns. “We haven't seen something that's projecting Givenchy into the future but also really grounded in the past. And I think that's what clicked, because the other attempts were either too much in the future and disconnected from the past, or too much in the past and not taking it anywhere new,” says Amed. “She proved what a great designer she is,” adds Blanks.Watching from home, Blanks was struck by the step-and-repeat that preceded the Off-White show, where attendees arrived in bold, expressive looks from the brand’s current collection. This real-life display of style, Blanks notes, “softened him up” for the actual runway. “You see the clothes on real people, so it's not like, ‘Who would wear this?’” he says. Amed highlights this as an added opportunity to capture customers watching online: “There's a step-and-repeat for what's available to buy now, and then there's the show for what's available for the future.”Additional Resources:Sarah Burton’s Givenchy Debut: First Principles Take FlightAckermann and Ford: A Deliciously Dangerous Liaison

Francesco Risso Says Fashion Should Slow Down to Find Its Magic Again

01:00:46|Born in Sardinia on a sailing boat to self-described “adventurous” parents, Francesco Risso grew up in an environment that fostered independence, spontaneity and a deep need to create. After formative years at Polimoda, FIT and Central Saint Martins — where he studied under the late Louise Wilson — he joined Prada, learning firsthand how to fuse conceptual exploration with a product that resonates in everyday life.Now at Marni, Risso continues to embrace a method he likens to an artist’s studio, championing bold experimentation and surrounding himself with collaborators who push each other to new heights of creativity. “Creativity is … in the way we give love to the things that we make and then we give to people. I feel I don’t see so much of that love around,” says Risso. “We have to inject into products a strong and beautiful sense of making. That requires craft, it requires skills, it requires a lot of fatigue, it requires discipline.”Risso joins BoF founder and CEO Imran Amed to explore how his unconventional childhood shaped his creative approach, why discipline and craft remain vital to fashion, and how meaningful collaboration can expand the boundaries of what’s possible.Key Insights: Growing up in a busy, non-traditional household, Risso learned to express himself by altering and reconstructing clothing he found in family closets. “I started to develop this need to make with my hands as a means to communicate,” he says. “I would find something in my grandmother’s closet, start to disrupt it and collage it to something from my sister’s wardrobe and we have a new piece.” This early experimentation laid the groundwork for his vision of and approach to design.From Louise Wilson at Central Saint Martins to Miuccia Prada, Risso has absorbed the value of rigorous research, conceptual thinking and extended ideation. “You have to rely on your own strengths and your own capability to go and study, to go and research, to go and find your things,” he says. “That is key to me, to become a designer with a voice.”Whether partnering with artists through an informal “residency” or collaborating with brands like Hoka, Risso insists that a great tie-up is never about simply sticking art on a T-shirt or rushing a gimmick. “Processes are about learning from each other … and that generates a body of work that then becomes either art or clothes.” His focus on genuine exchange expands the creative horizon for both Marni and its collaborators.Risso’s advice to emerging designers is to appreciate the fundamentals of making in favour of more superficial aspirations. “I dare young people to be more focused on engaging with the making, rather than just projecting in the future,” he says. “A strong sense of making requires craft, it requires skills, it requires a lot of fatigue, it requires discipline.” This hands-on grounding, in his view, is essential for developing a lasting, meaningful design practice.Additional Resources:Francesco Risso | BoF 500 | The People Shaping the Global Fashion Industry Exclusive: Inside Hoka’s Fashion Ambitions | BoFBackstage Pass | Marni and the Thread of Beauty | BoF

Can Farfetch Be Fixed?

27:33|Once hailed as a pioneering platform for online luxury, Farfetch is now undergoing a dramatic operational overhaul. The South Korean e-commerce giant Coupang acquired the luxury marketplace in 2023, rescuing it from near-bankruptcy. Since then, Coupang has implemented sweeping cost-cutting measures that have narrowed losses significantly, but are eroding Farfetch’s footing in the luxury e-commerce space and alienating its core customers. DTC correspondent Malique Morris joins Executive Editor Brian Baskin and Senior Correspondent Sheena Butler-Young to examine Farfetch’s path to profitability.Key Insights: Coupang's relentless drive to push Farfetch toward profitability clashes with the premium expectations of luxury shoppers as cost-cutting is prioritised over customer experience. “Coupang is so hyper‐focused on getting Farfetch to profitability ... and when you're dealing with people who are spending $100,000 a year on the marketplace, it doesn't quite work that way,” explains Morris. “They’ve also cut teams dedicated to working with Farfetch’s VIP customers, who can make up as much as 30% of the company’s annual sales.” This tension between operational efficiency and delivering a high-end experience is at the heart of Farfetch's challenges.Farfetch’s “sold by Farfetch” programme highlights its growing disconnect with luxury brands. As luxury powerhouses like Celine, Alaia and Kering – which includes Gucci, Saint Laurent and Bottega Veneta — pull their collections from the platform, Farfetch has turned to a grey market tactic to maintain its inventory. “Instead of sending the goods straight from the retailers to the customers, the items are now going to a warehouse in Amsterdam to be repackaged,” says Morris. “It's not only a knock to Farfetch's relationship with top brands, but it also risks deteriorating customer service.” This move, intended to sidestep brand resistance risks undermining transparency and trust among high-end partners.Farfetch's biggest superpower is that many independent boutiques still rely on it. “If Farfetch can at least do right by those retail partners, then it probably has a shot of stabilising its footing in online luxury,” says Morris. “Coupang will eventually have to allow Farfetch to reinvest in their relationships with customers and brands. That might cost them a couple million, but hopefully with the renewed focus on just the marketplace, Farfetch won't go back into the red in the process.”Additional Resources:Inside Coupang’s Tug of War With Farfetch | BoFFarfetch Owner Coupang: Everything You Need to Know | BoF